Know your NPV from your IRR

This blog post was first featured on the SA Innovation Summit blog here.

If you are an entrepreneur, you have probably heard of Net Present Value (NPV) and Internal Rate of Return (IRR) before. You might even have used these financial metrics in the past to value your business or technology, or to help you make financial decisions. But how confident are you that you understand these metrics and know how and when to use them?

If you are an entrepreneur, you have probably heard of Net Present Value (NPV) and Internal Rate of Return (IRR) before. You might even have used these financial metrics in the past to value your business or technology, or to help you make financial decisions. But how confident are you that you understand these metrics and know how and when to use them?

This blog post will provide a brief introduction to NPV and IRR and mention some advantages and disadvantages of each. You can learn a lot more about NPV, IRR, how to use them and related metrics like unacost, MIRR and EPVI (Excess Present Value Index) in the Moolman Institute Course Financial Modeling for Entrepreneurs 101: Master the Key Financial Concepts.

Why does money have a time value?

Money has a time value. The same amount of money is worth more in the present than in the future. To understand why this is so, imagine that you will receive $1 million at a specific date. There is a huge difference between that date being now or 40 years into the future. Until you receive the money, you cannot do anything with it.

Money has a time value. The same amount of money is worth more in the present than in the future. To understand why this is so, imagine that you will receive $1 million at a specific date. There is a huge difference between that date being now or 40 years into the future. Until you receive the money, you cannot do anything with it.

This is why money has a time value – because of the opportunity cost. Money in the present is worth more than the same amount of money in the future, because of its potential earning capacity. When you have the money, you can do things with it (such as investing it and earning a return).

What are present value and future value?

If money has a time value, then one should be able to calculate its value at any one point in time based on knowledge of its value at another point in time, as well as the relevant rate of change of value versus time.

The value of money at the present time is referred to as Present Value and at a future time Future Value.

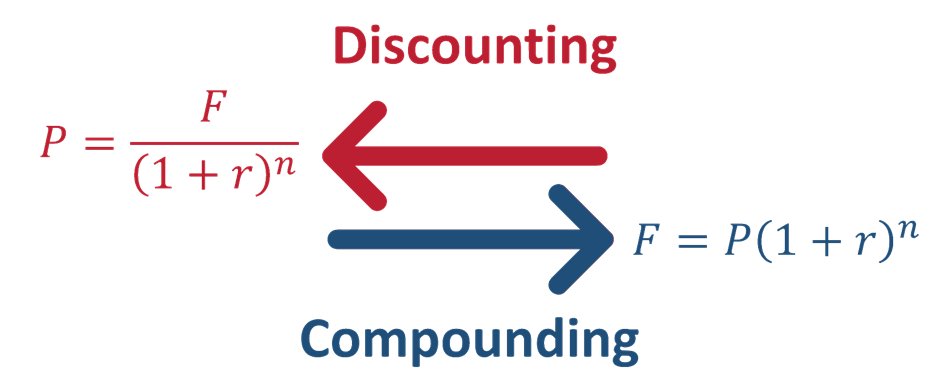

Below are two equations for converting values from the present to a future date and the inverse.

where

P = Present Value

F = Future Value

r = discount rate per period n (typically per year)

n = number of periods (typically years)

The process of moving money backwards in time from a future time to the present time is called discounting and moving forwards in time from the present to the future is called compounding.

What is Net Present Value (NPV)?

When you want to assess the financial implications of a project, company, investment, technology or expense, you need to look at all the cash flows (in and out) and their timing (remember that money has a time value). How does the total incoming cash flow compare with the total outgoing cash flow?

Stated in another way, if we look at the present values of all the cash inflows and outflows (to compare apples with apples), is it net positive or net negative? What is its magnitude compared with other options?

To answer this question, we use the Net Present Value.

Spreadsheets such as Excel have a built-in NPV function, but here is the equation for calculating NPV:

where:

r = discount rate

n = year

N = analytical horizon or project life (in years)

Cn = cash flow in year n

What is Internal Rate of Return (IRR)?

The Internal Rate of Return or IRR is a measure of the size of the returns vs. the size of the investment for a series of cash flows in the form of a percentage return. The series of cash flows is usually that which is generated by a project, company, investment or technology.

Although not exactly the same, at the simplest level you can think of the IRR as interest to be earned on an investment or deposit. (A big difference is that IRR is usually not guaranteed, but rather an estimate of potential future returns.)

The IRR is not that easy to calculate, but luckily most spreadsheet software packages have built-in IRR functions.

So… which is better – NPV or IRR? Which should I use to evaluate my company or technology?

Both NPV and IRR have advantages and disadvantages.

Both NPV and IRR have advantages and disadvantages.

Whilst NPV takes into account cost of capital, it is difficult to determine what rate you should use. Whilst IRR (as a percentage return) is more intuitive to understand, it cannot be used in all situations and can overstate returns.

The short answer regarding which is better: you should strive to always use BOTH! They each provide a different view on the financial viability or attractiveness of the investment opportunity.

Also, both have significant limitations, such as NPV not taking different project durations into account and IRR being distorted by large early cash flows. There are related financial metrics that overcome these limitations – more about that in the course mentioned below.

To learn more about NPV, IRR, how to use them and related metrics like unacost, MIRR and EPVI (Excess Present Value Index), enrol for the Moolman Institute Course Financial Modeling for Entrepreneurs 101: Master the Key Financial Concepts.

Recent Comments